Travel insurance or Health Insurance for Digital Nomads: A useful’ish guide

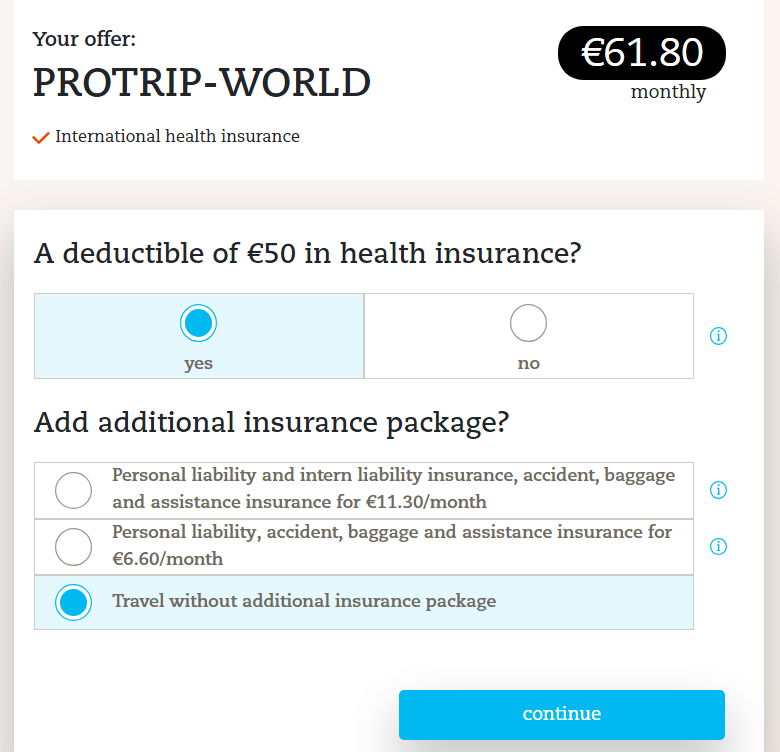

TL;DR: International health insurance is different from Travel insurance. If you’re staying in one spot for a longer stretch, private medical insurance in that country might be the way to go. However, if you’re hopping between countries and looking for international health insurance as a digital nomad, I’d really recommend Protrip World (a Dr Walter company, underwritten by Allianz). I’m not affiliated with them—yet—but based on my research, they seem like best option, and some of the other providers you might see in your own research actually use them under their slightly more modern ‘gen z’ branding (you just pay a bit more because of the branding, so go direct and cut out the middleman).

Insurance: The Murky but Necessary Evil

Let’s face it—insurance is not exactly the most thrilling topic. In fact, it’s the kind of subject that makes you want to slowly back away, preferably towards a hammock with a mojito. But when you’re living the digital nomad life, hopping from one country to the next, having some form of health coverage is essential.

Now, I didn’t exactly know where to start when I sat down to write this. Essentially I’ve wasted an afternoon trying to copy one of my competitors. They had sent out a newsletter promoting their shiny new travel insurance partner, and I thought, “Well, that’s a clever idea. I bet they make a tidy sum from referrals.” I even started the process to become an ambassador for the same insurance company. But then it didn’t feel right—I was like Ben!, this is not how you do things!

So, I stopped. I dug a little deeper, did some due diligence, as there’s more to this than slapping on a referral link and calling it a day.

Travel Insurance vs. International Health Insurance: Not the Same Thing

First things first, travel insurance and international health insurance are very different beasts.

Travel insurance is for those absolute emergencies (nothing more than lifesaving) whilst traveling. If you’re working abroad and not returning home what about doctors and dental expenses, and moving between countries frequently (as many digital nomads do), then that is what international health insurance is meant for (but it’s not cheap!). If you’re staying in one spot for a longer stretch, private medical insurance in that country might be the way to go. I’ll share some recommendations when we expand into more countries (currently we’re only in Tenerife, and I personally have taken out private health care in Tenerife, so I’ll provide more info on that in a future edit/update).

As for my competitor’s insurance choice? I won’t name names, but let’s just say that after a little Reddit sleuthing, I wouldn’t go with them (…think going to hospital, having to cover the bill upfront, and hoping you’ll get it back in 45 days). …and I call them a competitor, they’re huge, a bit like the wework equivalent of the coliving world (whereas I have one, yet to open, small space).

The Deep Dive Into the Insurance Abyss

In the spirit of doing things properly, I decided to delve deep into the fine print of the various “digital nomad” health insurance providers. This wasn’t a quick Google search. Oh no—I went down a rabbit warren of insurance websites, blog posts, and Reddit forums. And I started looking into the companies that actually underwrite these policies, because, as it turns out, the company selling you insurance isn’t always the one paying out your claims.

That’s when I discovered DR-WALTER, the company behind Protrip World, which ended up being my top recommendation, as it kind of cuts out a few middlemen. DR-WALTER administers it and its underwritten by Allianz, together they do various health insurance policies for travelers, expats, and yes—digital nomads like us. They’re a well-established players in this space, which gave me some peace of mind. So while I don’t have a perfect answer for everyone (because insurance is such a personal thing), Protrip World seems like a solid choice based on my research.

The Murky World of Insurance

Insurance is tricky because it’s highly personalized—everything depends on who you are, where you’re from, your age, any pre-existing conditions, and how long you’re staying in a given country. And then there are those unsettling Reddit horror stories about claims being denied because of fine print in the T&Cs.

There’s also the issue of when your insurance actually kicks in. Some policies cover you from the moment you enter the hospital, while others only do so after you’ve already paid out of pocket. Lucky for me, I’ve never had to make a claim, but I’ve read enough to be paranoid.

Why Not Just Get Travel Insurance?

Initially, I thought I could just recommend an annual travel insurance plan or a backpacker policy. But here’s the thing: those only cover emergencies. They won’t help with ongoing medical care or non-urgent stuff like, say, a dentist visit. (This hits close to home—my toothache is currently reminding me how important dental care is!)

And then there’s the big question—are you technically covered if you’re working remotely as a digital nomad? Some policies might say no, depending on the fine print.

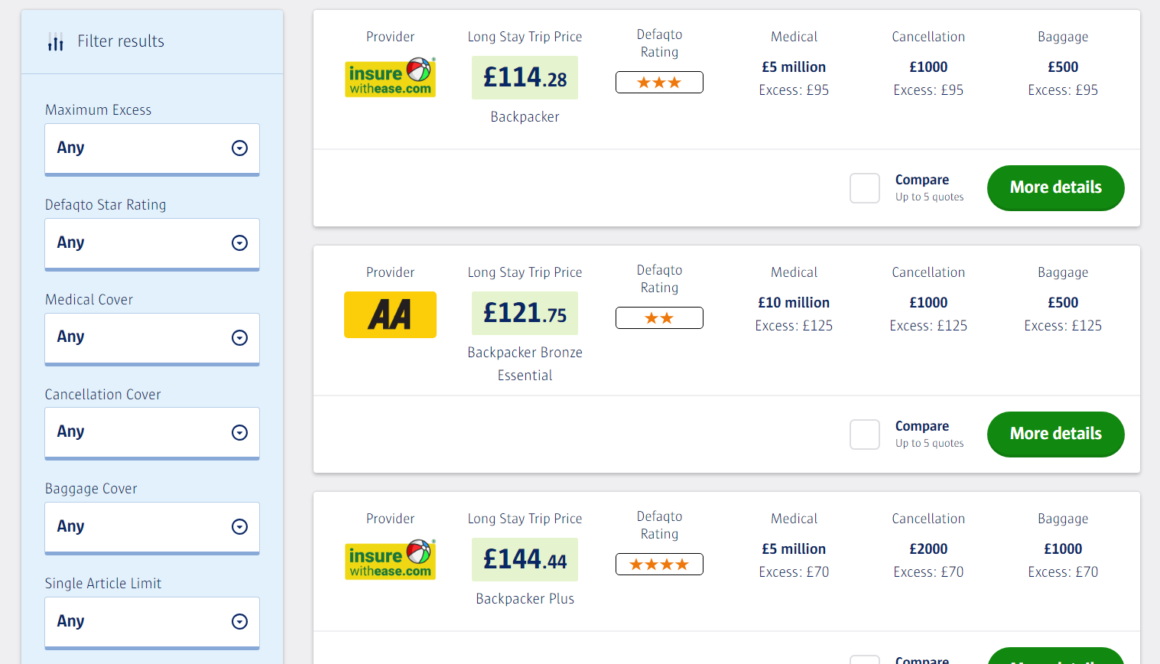

I remember when I was backpacking, I would just grab the cheapest policy to reassure my mom that I had “some” coverage. Looking back, I see how naïve I was—those were the days of blissful youth.

So, What’s the Cost?

Right now, I’m looking at about £115 per year for basic travel insurance, but with all the red flags I’ve read about, I’m sceptical it’ll cover anything I actually need. On the other hand, international health insurance would be around £55 per month.

Resources I Found Helpful:

- Banker on Wheels: Financial tips for travelers

- Brent and Michael Are Going Places: Practical advice from fellow nomads

- This Reddit Thread: “Extremely Disappointed in SafetyWing Classic”

Conclusion

I started this post thinking I’d slap on some referral links and maybe earn an extra few pennies each month. Now, after diving into this murky topic, I’m a little more broken inside (insurance will do that to you), but hopefully a bit wiser. I’ll update this as I learn more, and as always, do your own research!